This newsletter prides itself on being "half glass full", just not today

Throughout the entire course of human history, there has been no better time to be alive than today. A staggering 75% of the world’s population lived in extreme poverty as recently as the 1950s. Today it’s less than one in ten. We have never been more free. Over half of all people live under a democracy, double what it was seventy five years ago. Collective education is at an all time high. Four out of five people were illiterate at the start of the twentieth century, versus today where it’s the literate that make up the 80% majority. There is a lot to be happy about….for now

Russia Ramps Up

348 days ago Russia invaded its western neighbor Ukraine. Since then, hundreds of thousands of troops from both sides of the conflict have been killed, millions of civilians displaced from their homes and eventual reconstruction efforts will take generations to complete. And the worst may still be ahead.

In recent days, Russia has had success in recapturing portions of the eastern city of Bakhmut. Ukraine’s biggest win as of late has come off the battlefield, scoring commitments for delivery of tanks from Germany and the United States among others. As we approach one full year of war, the risk of this conflict escalating from regional matter to global event is growing in size. Russian President Vladimir Putin has not taken the use of nuclear weapons off the table, and certainly doesn't come across as someone open to accepting defeat. For all parties involved, the question must be asked: what’s the exit strategy here?

Debt Ceiling Debacle

On January 19th the United States reached its maximum level of borrowing permitted by Congress. Two weeks later and a solution is nowhere in sight. Republicans desire to raise the limit only when paired with cuts in spending. Seems reasonable. Democrats in response have requested a detailed itemization of categories in which cuts are to occur. Also reasonable.

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship."

- Alexander Fraser Tytler

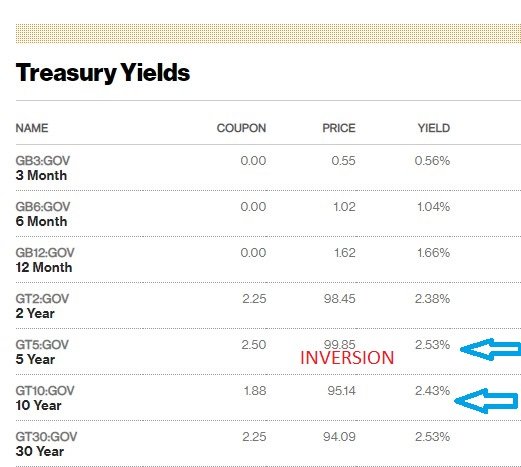

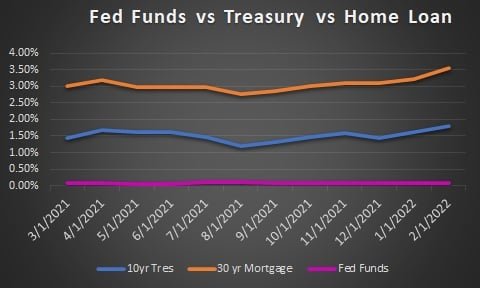

What hangs in the balance is the possibility that for the first time in its history, America defaults on its debt obligations. Domestically this would be very painful. The Treasury would be unable to fund Social Security, salaries for military personnel along with tax refunds. Internationally this would almost certainly trigger a credit downgrade of U.S. debt. All future borrowing (which we love to do, see graph below) would be at a higher interest rate.

The outcome if this occurs is serious. A growing portion of our tax dollars are wasted paying interest, versus being deployed in our communities where it’s needed most.

Tension over Taiwan

Surely the world’s two largest economies wouldn't go to war? Don’t be so certain. When asked last Fall if the United States would defend the island, President Biden responded "Yes, if in fact, there was an unprecedented attack." Yikes.

The strain stems from Beijing's One China policy, which states Taiwan is an inalienable part of China's territory, and the Government of the People's Republic of China is the sole legal government representing the whole of China. For decades, America has taken a strategic ambiguity approach when it comes to Tiwanese independence.

So why rock the boat? China and the United States each account for roughly 20% of world GDP. Asia as a whole however is responsible for 50%, meaning a growing China influence over the continent puts America in a place of diminishing strength. While onshoring of manufacturing jobs is currently the flavor of the month, even if it could be successful (will Americans in mass take jobs assembling T.Vs?) it would take decades to achieve. In the meantime, we will continue to rely on Asia to produce the majority of what North American consumers demand. The most likely first casualty of China and the U.S. butting heads? TikTok

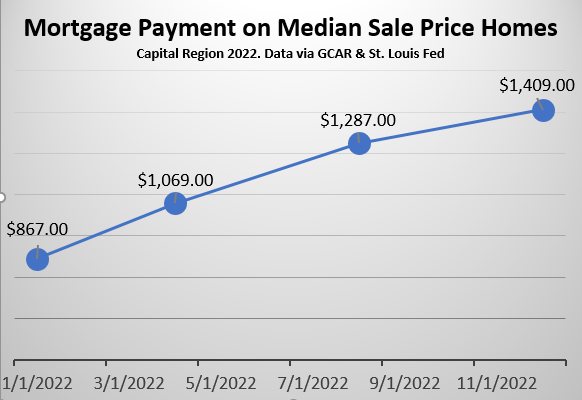

Irritating Inflation

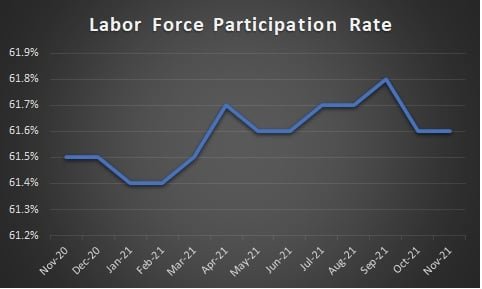

There are just certain words that feel worn out. “Covid”, “Trump” and “Inflation” certainly make the list. An argument could be made however that the first two are primarily rearview issues, whereas inflation very much remains in our lives. The prices paid by consumers has not increased this drastically year over year since the early 1980s. This means a significant portion of the country (and almost the entirety of my readership, shout out to the millennials 👍) have zero life experience during a period of prolonged inflation.

Economies become unhinged when prices become overly volatile. Civilians spend less and businesses delay investments, both negative events with snowballing effects.

For what seems like all of eternity the U.S. dollar has been treated as the world’s currency. This status is a privilege, not a right. The leaders of Brazil and Argentina announced last month plans to create a common currency, designed in large part to reduce their reliance on the greenback. Couple this with efforts by President Xi in China to increase use of the Yuan world wide, and countries like El Salvador experimenting with crypto currency and it’s possible that dollar dominance has come and gone.

As stated in the open, there is much to be excited about. The pace at which the world is improving socially, economically and politically is inspiring. At the same time, let’s remain vigilant. President Reagen coined the phrase “Trust, but verify”. Well for 2023 my policy will be “Happy, but watchful”.

If you've enjoyed the article I would encourage you to follow us on Facebook, Twitter, Instagram & YouTube for additional content. As a local growing real estate firm all social media follows/interactions carry significant importance. Plus, we'd love to hear from you!

Considering buying or selling in the Capital Region? Schedule a phone or Zoom call with me here

NYS Fair Housing Notice

Steven Luttman

Broker/Owner SJLincoln Realty

35 Bath Street, Ballston Spa NY 12020

(518) 309-8584