A Year in Review: 2021

Hello friends,

One quick announcement prior to starting the year end summary, there is now a podcast! A brand new project The Expected Returns Podcast is up and running. This will be a real estate focused conversation touching on markets, economic data and financial literacy. Existing episodes can be accessed by either clicking here or the image below. Hopefully this is something you'll find worth subscribing to.

2021

A year that started with vaccines and substantial financial market fluctuations ends with boosters and more substantial market fluctuations. In-between saw unemployment rates plummet, inflation reach generational levels, asset prices tear higher and so much more. To best anticipate the year ahead lets look back at 2021.

Housing Sales

Low interest rates throughout the year allowed buyer's purchasing power to remain strong. Millennials, who for years delayed becoming homeowners, now at 37% represent the largest demographic of all buyers. While the pace has slowed, those who are able to work remote continue to choose owning space in the suburbs versus renting city conveniences. Various metrics show U.S. home price growth of anywhere between 12% and 19%.

Locally market conditions were much less dramatic. While the state saw negative net migration of over 200,000 residents, some pockets (Saratoga County being one) remained strong. Capital Region home sales saw a roughly 6.50% increase over the previous year.

Employment

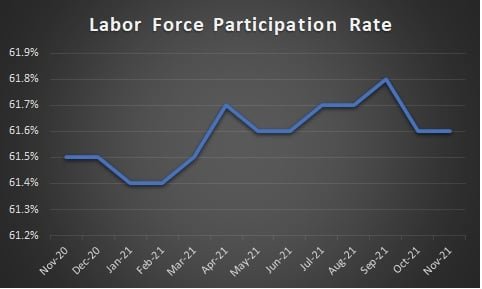

The first jobs report under President Biden surprised to the positive side, with unemployment dipping forty basis points to 6.3%. This was offset however by a reduction in the labor force participation rate, meaning the decrease was more attributed to individuals leaving the workforce versus the economy gaining new participants. As employers ramped up hiring three factors were blamed throughout the year large numbers of folks remaining on the sidelines: uneasiness about contracting the virus, lack of schooling/daycare options for those with children and enhanced unemployment benefits.

While the unemployment rate fell steadily in 2021 the labor force participation rate was mostly unmoved. According to the Bureau of Labor Statistics there are currently 4 million less filled jobs in the economy than there were pre pandemic.

Stock Market

Equity investors continued to be the beneficiary of low interest rates for a majority of the year. Gains were not limited to only a few high flyers, but instead double digit gains were to be had in a majority of sectors within the economy. Announced rate hikes by the Federal Reserve planned for Spring 2022 have dampened December returns, especially to rate sensitive technology companies.

Predictions in Review

How did we do on last years predictions?

1. "Fears over a mounting U.S. national debt and decreasing dollar will help see Bitcoin outperform the S&P 500"

Nailed it. While the S&P 500 returned 23% (as of the date of this publication) Bitcoin neared a full double at 99%.

2. "Facing a massive budget shortfall NYS will okay regulated online sports betting"

We are on fire! Nine online sportsbook operators were awarded licenses in November and are expected to be operational by the Super Bowl.

3. "Housing prices will continue climbing into Q2, where they will stagnate following an influx of inventory from distressed sellers who have exhausted all forbearance options."

Big "L" on this one. The expected influx of inventory never arrived, and when paired with city renters turning into suburb buyers home prices rose throughout 2021. Case-Shiller's U.S. National Home Price index was up 19.5% year over year as of November.

4. "Saratoga Race track will host 50,000 live fans for Travers Day 2021".

Technically wrong, but I'm going to chalk this one up as a draw. 44,507 was the attendance figure for Travers day. Total patrons for the meet exceeded 1 million, far above expectations heading into the Summer.

Predictions for 2022

Lets see if we can't improve upon our 2-1-1 record from last year....

1. Supply chain constraints will loosen as overseas factories reopen and domestic ports work through current backlogs. The Consumer Price Index (inflation gauge) will end the year sub 3.75%

2. If a prediction ain't broke don't fix it, Bitcoin outperforms the S&P 500 for the 3rd straight year.

3. Increasing interest rates and downward pressure on wages caused by more people returning to the work force will help decelerate home price growth to no more than 4.0%.

4. Saratoga Race track will set a new record for overall meet attendance. 1,065,625 set in 2015 is the number to beat. BONUS: Gunite, trained by Steve Asmussen wins the Travers.

I'll wrap up with a giant and sincere thank you to all those who helped not only myself but the business over the past twelve months. Whether a friend, family member, client or some combination of either, your support has been meaningful. Thank you.

-Steve

If you've enjoyed the article I would encourage you to follow us on Facebook, Twitter, Instagram & YouTube for additional content. As a local growing real estate firm all social media follows/interactions carry significant importance. Plus, we'd love to hear from you!

Considering buying or selling in the Capital Region? Schedule a phone or Zoom call with me here

NYS Fair Housing Notice

Steven Luttman

Broker/Owner SJLincoln Realty

35 Bath Street, Ballston Spa NY 12020

(518) 309-8584