Homebuyers Pressured by Concurrent

Rising Prices & Borrowing Costs

Hello friends,

The world has become a much more expensive place than when we last chatted. Inflation concerns prompted the Federal Reserve to end Q.E. come March, which will coincide with an increase in the Fed Funds rate for the first time since 2018. At the same time, lumber prices, wages for skilled labor and raw land values continue to rise, putting upward pressure on home values. This environment of both rising prices and cost of capital is an uncomfortable place to be for homebuyers.

Powell's Power

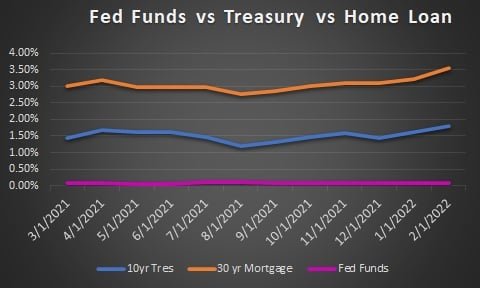

While not unexpected the policy shift by Chairman Powell on rates created significant volatility in the bond market, resulting in long term Treasury yields shooting up close to 40 basis points from where they began the year. This in turn moved mortgage rates north, with the national average on a 30 year term nearing a full percentage point higher than the 52 week lows. While movement in treasuries is not directly tied to mortgage rates, we can see in the graph below that the two are in fact highly corelated.

Houses Don't Grow on Trees

This past week Zillow revised their 2022 housing forecast to reflect prices increasing 16.4% over the next twelve months. The main driver? Inventory continues to remain below healthy levels. When interest rates rise current owners become less inclined to trade up or to downsize, as it would require giving up a rate possibly sub 3% in exchange for something creeping towards a full point hire. This is on top of pressures from rising input costs and labor that we've discussed in previous posts.

What to Watch This Week

Tuesday, February 8th: GlobalFoundries releases its Q4 earnings. The Capital Regions 7th largest employer started publicly trading September of last year. Details on their second fab location in Malta remain unclear.

Thursday, February 10th: Consumer Price Index for the month of January. The inflation gauge created headlines last month as it reached its highest level in decades, which economists predict will be eclipsed with this weeks report.

Sunday, February 13th: SuperBowl LVI from Los Angeles, CA. Ticket prices on the secondary market currently no less than $5,000 per seat. For those of you addicted to gambling we like the Ram -4.

If you've enjoyed the article I would encourage you to follow us on Facebook, Twitter, Instagram & YouTube for additional content. As a local growing real estate firm all social media follows/interactions carry significant importance. Plus, we'd love to hear from you!

Considering buying or selling in the Capital Region? Schedule a phone or Zoom call with me here

NYS Fair Housing Notice

Steven Luttman

Broker/Owner SJLincoln Realty

35 Bath Street, Ballston Spa NY 12020

(518) 309-8584