Resesh 📉 or Refresh🌼???

Experts Warn of an Impending Recession. Is This to be Feared, or Welcomed as a New Beginning?

Hello friends,

The Federal Reserve is tasked with two objectives, maintain steady prices and reach maximum employment. Mission accomplished on the latter. While the historical average in our country of folks within the labor force seeking work is 5.76%, despite a 24 month global shutdown the rate currently sits at a measly 3.8%. Prices on the other hand have turned out to be a bit trickier to manage. Chairman Powell stated as recently as November 2021 that "We don’t think it’s a good time to raise interest rates..." as he believed cost increases were transitory, or short term in nature.

Fast forward four months and not only did he hike, but forecasted an additional 6 bumps prior to year end. As we wrap up Q1 the question becomes is the end of record low borrowing costs harmful given current events, or beneficial as we move forward?

"Check out those curves! "

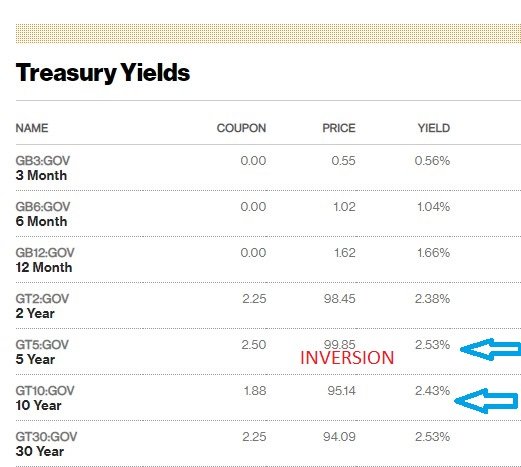

Long dated Treasuries almost always pay a higher yield than shorter dated ones. Why? Because the longer the timeframe the more risk you as the investor take on. Imagine committing your money for ten years at 2%, only for a year later to see the same product paying 3%. Bummer!

In rare instances however this will flip. Known as a yield curve inversion experts point to this as a flashing red alarm that a recession is coming. Here's the explanation: the only reason a buyer would agree to purchase longer dated commitments that pay less than their short dated counterparts is if they believed there to be long term economic turbulence, and therefore want a guaranteed return instead of the perceived doom and gloom offered by future equity markets. Concentrated buying of long dated debt increases their price, drives down yields and inverts the curve..

Pack your bags...we're going hiking

If six additional rate increases were to occur then the Fed Funds rate would end the year somewhere around 2.0%. Should this come to fruition the argument can be made its actually a positive sign, as the Fed would have viewed the economy being healthy enough to absorb these increases. Eventually there will be another financial downtown, and when this occurs its imperative the Fed have room to stimulate the economy. If rates are held at/near zero in perpetuity policy makers would have almost no maneuverability. Corporate balance sheets are strong and unemployment is low. If there's ever a time to start increasing rates it appears now would be just as appropriate as any.

What We're Watching

Tuesday, March 29th: February 2022 Job Quits

Recently coined " The Great Resignation" a large number of employees choosing to leave their jobs is generally viewed as a sign of a healthy economy, as workers anticipate being able to find better alternatives.

Friday, April 1st: March 2022 Unemployment Rate

A majority of March predated rising rates, so Friday's reading will likely be the lowest figure for the foreseeable future. .

If you've enjoyed the article I would encourage you to follow us on Facebook, Twitter, Instagram & YouTube for additional content. As a local growing real estate firm all social media follows/interactions carry significant importance. Plus, we'd love to hear from you!

Considering buying or selling in the Capital Region? Schedule a phone or Zoom call with me here

NYS Fair Housing Notice

Steven Luttman

Broker/Owner SJLincoln Realty

35 Bath Street, Ballston Spa NY 12020

(518) 309-8584